First Fulfillment Services with 20% Off

Sign up today and save 20% on your first order. Fast, affordable, tax-free Amazon prep fulfillment.

An open fee system with no surprise charges is always better.

Quicker processing means that your inventory gets listed and available for customers faster, resulting in higher sales.

A prep center with scalability ensures you never need to switch providers as you scale your business.

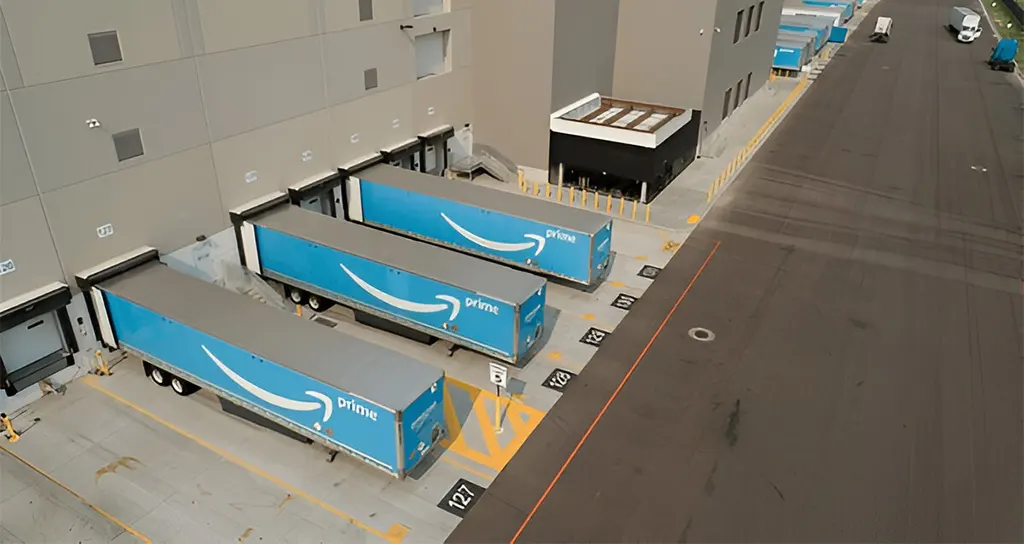

A tax free Amazon prep center is a fulfillment service located in a sales-tax-free state like Oregon, Montana, New Hampshire, or Delaware. These centers handle storage, labeling, packaging, and shipping without charging sales tax, helping Amazon sellers significantly reduce operating costs and maximize profits.

To confirm a prep center’s tax free status, check if it’s based in a state without sales tax and ask for documentation or proof. Also, review their pricing carefully to ensure there are no hidden fees that could impact your savings.

When choosing a prep center, compare their pricing structures, service packages, turnaround times, customer reviews, scalability options, and ability to integrate with platforms like Amazon Seller Central for smooth operations.

Fast turnaround times ensure that your inventory reaches Amazon FBA warehouses quickly, preventing stockouts and missed sales opportunities. Always ask about their standard processing times and rush order options.

Yes, it’s highly recommended to start with a small batch of products to evaluate their service quality, compliance with Amazon standards, communication, and potential hidden charges before sending your full inventory.

Need efficient logistics? We offer hassle-free shipping, warehousing, and supply chain solutions to ensure safe, on-time delivery!

Sign up today and save 20% on your first order. Fast, affordable, tax-free Amazon prep fulfillment.