First Fulfillment Services with 20% Off

Sign up today and save 20% on your first order. Fast, affordable, tax-free Amazon prep fulfillment.

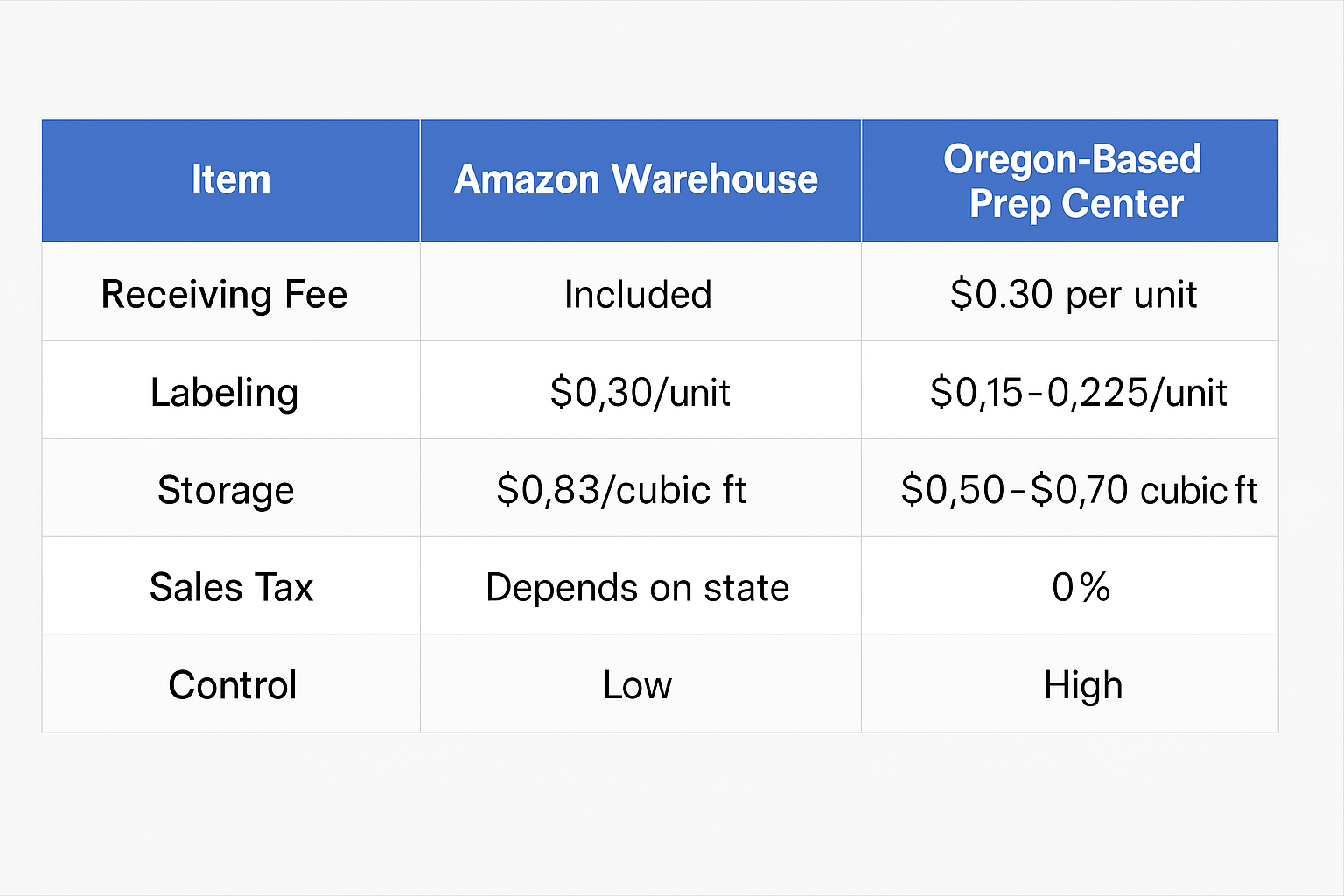

Choosing the appropriate fulfillment strategy can have a big impact on your bottom line in the e-commerce industry. Using Amazon’s own warehouses (through FBA) or outsourcing to a third-party prep center are the two primary options that Amazon sellers typically have to choose between. Although each option has advantages, using tax free Amazon services in Oregon and other tax-exempt states to cut expenses and increase profit margins is becoming more and more popular.

We’ll explain the distinctions between third-party prep centers and Amazon warehouses in this guide, particularly those in tax-free states, so you can choose the one that’s best for your company.

With the Fulfillment by Amazon (FBA) service, sellers send their goods to Amazon’s fulfillment centers, and Amazon handles returns, customer support, packaging, shipping, and storage.

Benefits of Using Amazon Warehouses:

Your products are eligible for Prime, which increases conversion and visibility.

After receiving inventory, Amazon takes care of almost everything.

Ideal for high-volume vendors who require dependable infrastructure.

The drawbacks of using Amazon warehouses:

Fulfillment and storage fees levied by Amazon can mount up rapidly.

In some states, storing goods may result in tax obligations.

You have little say in how your goods are handled or packaged.

You and Amazon are connected by third-party prep centers. They take care of inspecting, labeling, bundling, poly bagging, and shipping your inventory to Amazon while making sure it complies with FBA regulations.

Using prep centers in tax-free states like Oregon, Montana, or Delaware is one significant benefit. Using tax-free Amazon services in Oregon has made Oregon a popular destination for sellers trying to reduce their tax obligations.

When you buy and prepare items in Oregon, you can avoid paying sales tax by using Amazon prep center tax free state services. Your total cost of goods sold (COGS) can be greatly reduced by doing this.

Compared to Amazon warehouses, many third-party centers offer more transparent pricing structures and charge less for prep and storage.

For sellers who wish to personalize their customer experience, you have complete control over how your products are packaged, branded, and shipped.

By avoiding Amazon's exorbitant LTSF (Long-Term Storage Fees), third-party centers frequently offer more adaptable and reasonably priced long-term storage options.

To keep you within restock limits, prep centers can serve as buffer warehouses, holding excess inventory that is then sent to Amazon as needed.

FBA works best for:

Fast inventory turnover and high volume sales.

Sellers who put an emphasis on quicker delivery times and Prime eligibility.

Companies that wish to completely outsource customer service and logistics.

However, FBA fees and tax exposure could quickly reduce your profits if you’re just starting out or operate on thinner margins.

Particularly in a tax-free state like Oregon, a prep center is perfect for:

Amazon FBA sellers want to increase control and cut expenses.

Companies that ship from foreign suppliers and require compliance and inspection.

Amazon's restock restrictions and long-term storage penalties have an impact on sellers.

Prep centers offer a clever method to maintain FBA compliance while maximizing profitability with tax free Amazon fulfillment services.

Let’s dissect it using a straightforward example:

When paired with tax free Amazon fulfillment services, even a few cents saved per unit can add up over hundreds or thousands of products.

A hybrid strategy is used by many profitable Amazon FBA sellers. To receive, check, prepare, and send inventory to Amazon warehouses, they use prep centers located in tax-free states. In this manner, they

Save money on preparation and taxes.

Maintain authority over branding and packaging.

Continue to take advantage of Amazon's extensive logistics network and Prime eligibility.

Your budget, growth plan, and business objectives should all be in line with your fulfillment strategy.

Amazon FBA may be the best option for you if you value complete automation and sell in large quantities. However, using tax free Amazon services in Oregon through a reputable prep center could give you the advantage if you’re just starting out, want more control, or are cost-conscious.

At the end of the day, long-term success, scalability, and profitability are more important than convenience. You can maximize your Amazon business and steer clear of common pitfalls with a little research and the correct fulfillment partner.

Amazon FBA warehouses handle storage, packaging, shipping, and customer service for sellers, offering fast delivery and Prime eligibility. Third-party prep centers, especially in tax-free states like Oregon, focus on preparing, inspecting, and shipping inventory to Amazon while offering more flexibility, lower costs, and reduced tax exposure.

Using a third-party prep center in a tax-free state helps Amazon sellers avoid sales tax, significantly lowering their cost of goods sold (COGS). It also provides affordable long-term storage, better control over packaging and branding, and helps sellers navigate Amazon’s restock limits and storage fees.

Amazon FBA is ideal for businesses with high inventory turnover, large sales volumes, and a need for fast Prime shipping. It’s perfect for sellers who want to fully outsource logistics and customer service, although it may not be cost-effective for newer or lower-margin businesses due to high fees.

A hybrid strategy, using both a third-party prep center and Amazon FBA, allows sellers to save on taxes and prep costs while still benefiting from Amazon’s logistics network and Prime eligibility. It offers the best of both worlds—cost control, branding flexibility, and scalable fulfillment.

Tax-free Amazon services, like those offered in Oregon, can save sellers significant money by eliminating sales tax on inventory purchases and preparation. Over time, these savings add up across hundreds or thousands of units, helping sellers improve profit margins and overall business profitability.

Need efficient logistics? We offer hassle-free shipping, warehousing, and supply chain solutions to ensure safe, on-time delivery!

Sign up today and save 20% on your first order. Fast, affordable, tax-free Amazon prep fulfillment.